| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| SCHEDULE 14A |

| Proxy Statement Pursuant to Section 14(a) of the |

| Securities Exchange Act of 1934 |

| (Amendment No. ) |

| Filed by the Registrant [X] | |||

| Filed by a | |||

| Check the appropriate box: | |||

| [ ] | Preliminary Proxy Statement | ||

| [ ] | Confidential, | ||

| Commission Only (as permitted | |||

| by Rule 14a-6(e)(2)) | |||

| [X] | Definitive Proxy Statement | ||

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting Material Under §240.14a-12 | ||

CHESAPEAKE UTILITIES CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i) | |

| (1) | Title of each class of securities to which transaction applies: | |

| Aggregate number of securities to which transaction applies: | ||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| Proposed maximum aggregate value of transaction: | ||

| Total fee paid: | ||

| [ ] | Fee paid previously with preliminary materials: | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |

| (1) | Amount previously paid: | |

| Form, Schedule or Registration Statement No.: | ||

| Filing Party: | ||

| Date Filed: | ||

Notice of 2017Virtual 2020 Annual Meeting of Stockholders

April 10, 2017

7, 2020

Dear Stockholder,

On May 3, 2017,7, 2020, Chesapeake Utilities Corporation (the "Company") will be holdinghold its 20172020 Annual Meeting of Stockholders (the "Meeting"). Due to the emerging public health impact of the coronavirus outbreak (COVID-19), and out of concern for the health and safety of our stockholders, directors, and members of management, the Meeting will be held in a virtual meeting format only. There will be no physical location for stockholders to attend the Meeting. Stockholders will be able to listen, vote and submit questions. If you plan to participate in the virtual Meeting, please see the Instructions for the Virtual Annual Meeting section in the attached Proxy Statement. Stockholders may participate in the Meeting by logging in at www.virtualshareholdermeeting.com/CPK2020. Stockholders of record at the close of business on March 10, 20172020 will be asked to:

| Proposal | Board Recommendation | |

| FOR each nominee | ||

| Proposal 2 | Non-binding advisory vote to approve the compensation of the Company's |

| Named Executive Officers | FOR | |

| FOR |

Stockholders will also transact any other business that is properly brought before the Meeting and at any adjournment or postponement of the Meeting. For any other business that is properly brought before the Meeting, the appointed proxies are authorized to vote pursuant to their discretion.

Your vote is important and we encourage you to vote as soon as possible even if you plan to attendparticipate in the virtual Meeting. Please read the attached Proxy Statement for additional information on the matters youwe are being askedasking you to vote on.

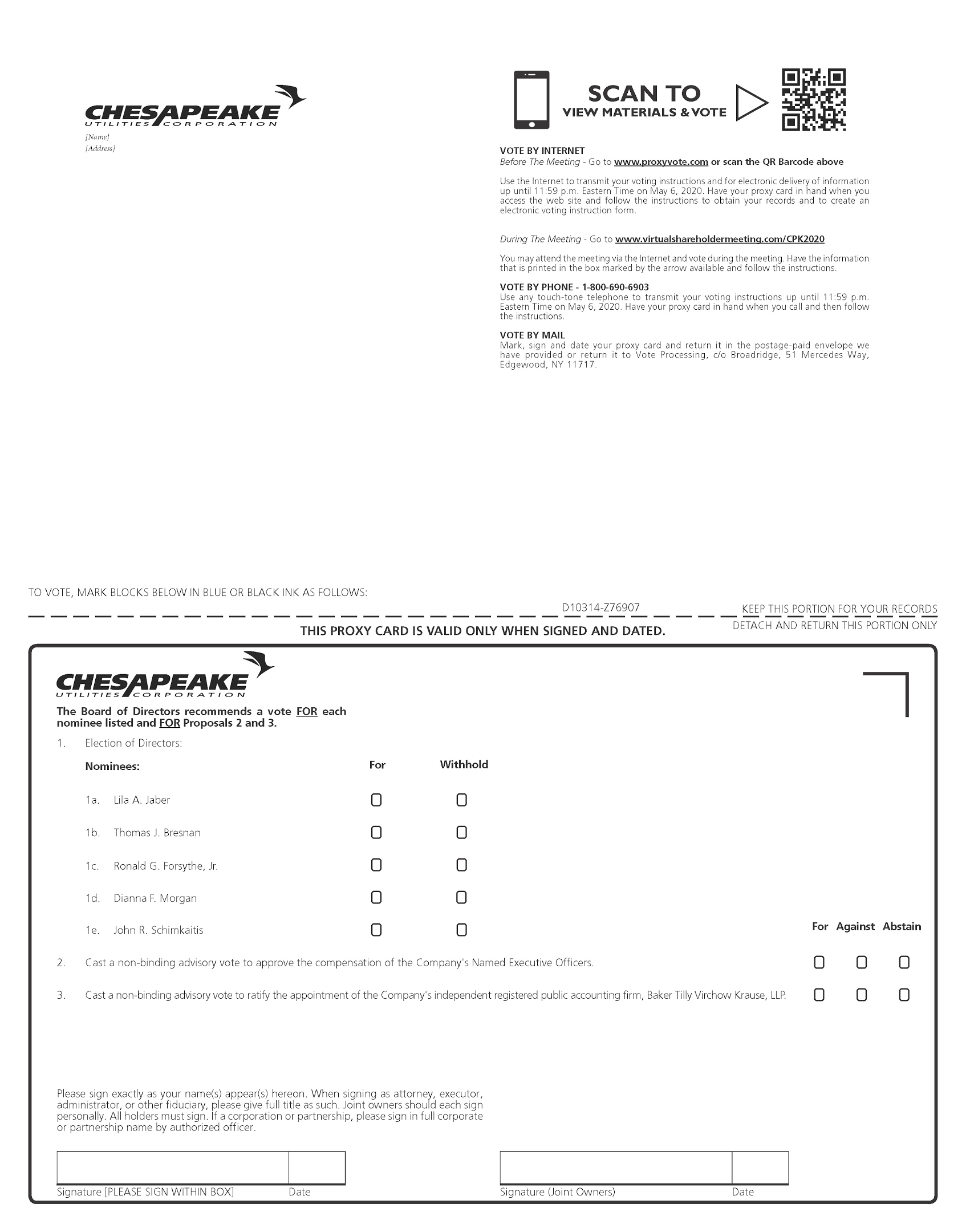

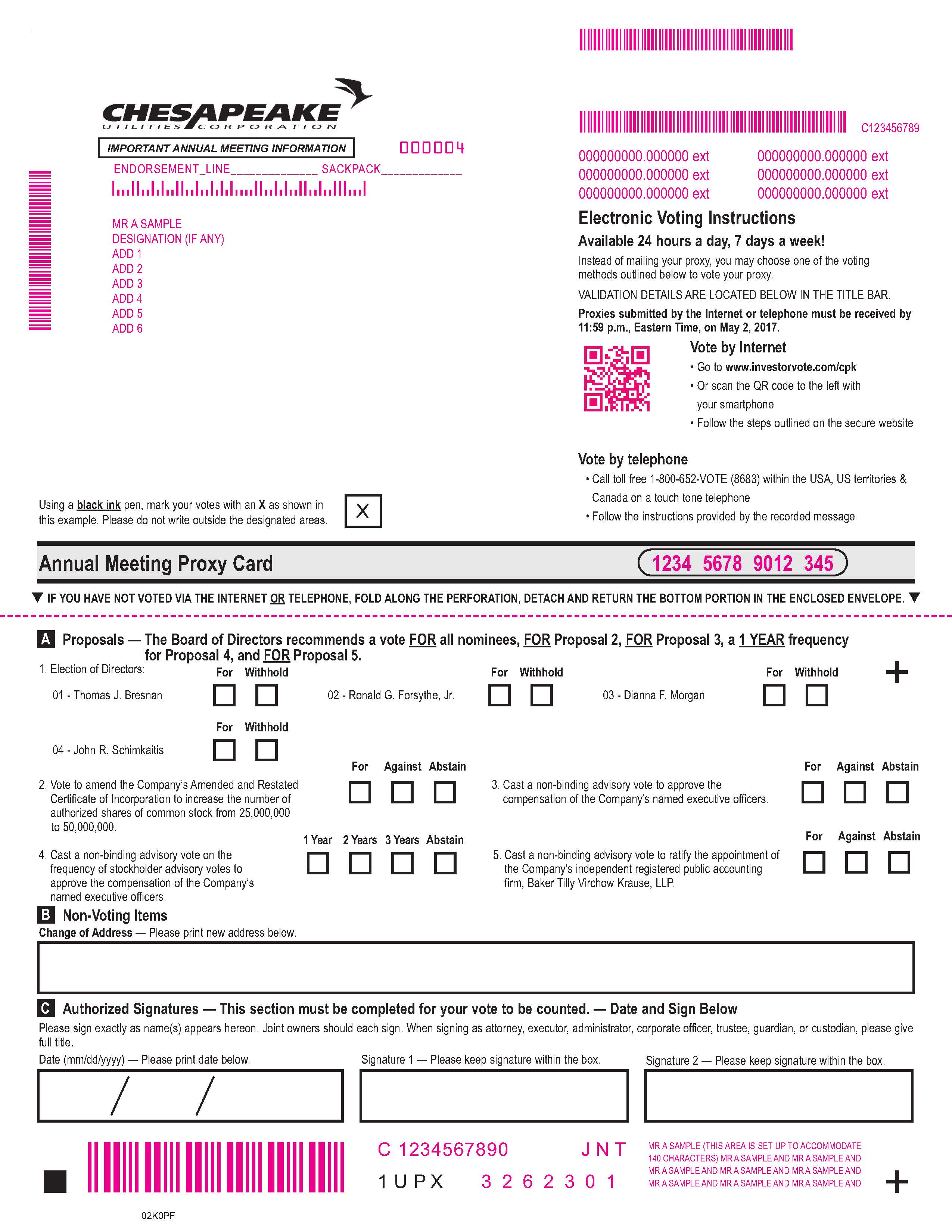

| Internet | Type www.proxyvote.com in your internet browser and enter the control number on your proxy card. | |

| Mobile Device | Scan the QR code on your proxy card with your mobile device and enter the control number on your proxy card. | |

| Telephone | Dial toll free (800) 690-6903 to reach our agent and follow the telephone prompts. | |

| Cast your ballot, sign and date your proxy card, and mail it in the enclosed envelope. | ||

If you own shares through your bank, broker or other institution or in an account established under one of the Company’s deferred compensation plans,Retirement Savings Plan, Deferred Compensation Plan, or other plan, you will receive separate instructions on how you can vote the shares you own in those accounts.

Thank you for your investment in Chesapeake Utilities Corporation.

Sincerely,

James F. Moriarty

and Chief Policy and Risk Officer

Important Notice Regarding the Availability of Proxy Materials. This Notice for the Virtual 2020 Annual Meeting of Stockholders to be held on May 3, 2017,7, 2020, the attached Proxy Statement (which includes instructions for attending our 2016virtual Annual Meeting), and our 2019 Annual Report on Form 10-K and directions to the Annual Meeting are available at www.chpk.com/proxymaterials.www.chpk.com/proxymaterials.

909 Silver Lake Boulevard, Dover, DE 19904 ▪ www.chpk.com ▪ (888) 742-5275

| 1 | Proxy Statement | ||

| 2 | Proposals | ||

| 3 | Audit Related Matters | ||

| 4 | Board of Directors and Its Committees | ||

| 5 | Corporate Governance and Stock Ownership | ||

| 6 | Our Engaging Culture | ||

| 7 | Director and Executive Compensation | ||

| 8 | Other Important Information | ||

GLOSSARY OF TERMS

| Statement. | ||

| 2015 Cash Plan: | The Company's Cash Bonus Incentive Plan as approved by our stockholders in May 2015 | |

| 2017 Equity Incentive Award: | An equity incentive award granted by the Compensation Committee pursuant to the SICP for the 2017-2019 performance period | |

| An equity incentive award granted by the Compensation Committee pursuant to the SICP for the 2018-2020 performance period | ||

| 2019 Equity Incentive Award: | An equity incentive award granted by the Compensation Committee pursuant to the SICP for the 2019-2021 performance period | |

| Aspire Energy: | Aspire Energy of Ohio, LLC, a wholly-owned subsidiary of Chesapeake Utilities | |

| Baker Tilly: | Baker Tilly Virchow Krause, LLP, the Company's independent registered public accounting firm, or our external audit firm | |

| Bylaws: | ||

| Bylaws, as amended through May 8, 2019 | ||

| Board: | ||

| Cash Incentive Award: | ||

| pursuant to the 2015 Cash Plan for the 2019 performance period | ||

| Chesapeake Utilities or Company: | Chesapeake Utilities Corporation, its divisions and subsidiaries, as appropriate in the context of the disclosure | |

| FW Cook: | Frederic W. Cook & Co., Inc., the Compensation Committee's independent compensation consultant | |

| Deferred Compensation Plan: | A non-qualified, deferred compensation plan under which compensation may be deferred by eligible participants | |

| Delmarva Peninsula: | A peninsula on the east coast of the U.S. occupied by Delaware and portions of Maryland and Virginia | |

| Dodd-Frank Act: | The Dodd-Frank Wall Street Reform and Consumer Protection Act | |

| EPS: | Basic earnings per share (GAAP unless otherwise noted) | |

| Exchange Act: | The Securities Exchange Act of 1934, as amended | |

| FASB: | Financial Accounting Standards Board | |

| FPU: | Florida Public Utilities Company, a wholly-owned subsidiary of Chesapeake Utilities | |

| IRS: | Internal Revenue Service | |

| Marlin Gas Transport: | Marlin Gas Transport, Inc., a wholly-owned subsidiary of Chesapeake Utilities | |

| Named Executive Officer, NEO, or Executive NEO: | Individuals as defined in Item 402(a)(3) of Regulation S-K are collectively referred to as "Named Executive Officers" or "NEOs." Four NEOs that currently serve as Executive Officers of the Company are collectively referred to as "Executive NEOs." | |

| NYSE: | New York Stock Exchange | |

| Public Company Accounting Oversight Board | ||

| Pension Plan: | A defined benefit pension plan sponsored by the Company | |

| Pension SERP: | An unfunded supplemental executive retirement pension plan sponsored by the Company | |

| PESCO: | Peninsula Energy Services Company, Inc., a wholly-owned subsidiary of Chesapeake Utilities | |

| The Company's qualified 401(k) retirement savings plan | ||

| ROE: | Return on equity | |

| SEC: | Securities and Exchange Commission | |

| SICP: | The Company's 2013 Stock and Incentive Compensation Plan | as approved by our stockholders in May 2013 and amended by the Compensation Committee of the Board in January 2017 |

| TSR: | ||

| Total shareholder return | ||

Enclosed are the proxy materials that describe each matter to be voted on by the stockholders, and information on the Company and its practices. The Notice of Virtual 2020 Annual Meeting of Stockholders, this Proxy Statement, and the enclosed Proxy Card are being furnished to our stockholders on or about April 7, 2020. We ask that you review each matter to be voted on at the Meeting and vote your shares using the methods described in this Proxy Statement. We thank you for your investment in the Company.

Summary of Proposals and Board Recommendations

This summary is an overview of information that you will receive separate instructions on howfind elsewhere in this Proxy Statement. This summary does not contain all of the information that you can voteshould consider, and you should read the shares you own in those accounts.entire Proxy Statement carefully before voting. With regard to Proposal 1, if elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement.

| Proposal Number | Description | Board of Directors' Vote Recommendation |

| 1 | Election of one Class II director for a two-year term ending in 2022 and election of four Class III directors | FOR each nominee |

| 2 | ||

Non-binding advisory vote to approve the compensation of the Company's | FOR | |

| Non-binding advisory vote to ratify the appointment of the | FOR | |

| Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Experience and Skills |

| Thomas J. Bresnan | 64 | 2001 | Owner and President, Accounting and Business School of the Rockies and Denver Accounting Services | Yes | Chair, Audit Committee Member, Investment Committee | • Executive Management• Sales and Marketing• Technology• Financial Expert |

| Ronald G. Forsythe, Jr. | 48 | 2014 | President and Chief Executive Officer, Quality Health Strategies | Yes | Member, Audit Committee | • Technology• Market Knowledge andEconomic Development (Delmarva Peninsula) • Organizational Positioning• Financial Expert |

| Dianna F. Morgan | 65 | 2008 | Former Senior Vice President of Public Affairs and Human Resources, Walt Disney World Company | Yes | Chair, Compensation Committee | • Leadership Development and Organizational Culture• Customer Experience• Media Relations• Government Relations |

| John R. Schimkaitis | 69 | 1996 | Chair of the Board of Directors, Chesapeake Utilities Corporation | Yes | Chair, Investment Committee | • Executive Management• Leadership Development• Energy Industry• Market Knowledge (Delmarva Peninsula and Florida) |

| Class II Director | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Experience and Skills |

| Lila A. Jaber | 53 | 2020 | President, Jaber Group Inc. | Yes | – | • Extensive experience in strategy, ethics, and government affairs • Established relationships with colleagues and members of the business and political community throughout Florida • In-depth knowledge of the energy industry and regulatory policy |

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 1

| Class III Directors | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Experience and Skills |

| Thomas J. Bresnan | 67 | 2001 | Owner & President, Career School of the Rockies and Denver Accounting Services | Yes | Audit Committee Chair Investment Committee Member | • Extensive leadership, technology, sales and marketing experience • In-depth experience in acquisitions and the post integration process • Financial and Audit Committee expertise |

| Ronald G. Forsythe, Jr. | 51 | 2014 | Chief Executive Officer, Qlarant Corporation | Yes | Audit Committee Member Compensation Committee Member | • Extensive experience in leadership, organizational positioning, energy, community engagement, and technology including cyber security • Established relationships with colleagues and members of the community throughout the Delmarva Peninsula • Financial and Audit Committee expertise |

| Dianna F. Morgan | 68 | 2008 | Former Senior Vice President, Walt Disney World Co. | Yes | Compensation Committee Chair Corporate Governance Committee Member | • Extensive public company, leadership development, and organizational culture experience • Expertise in human capital, public affairs and the customer experience • In-depth knowledge in media relations and government relations |

| John R. Schimkaitis | 72 | 1996 | Retired President and Chief Executive Officer, Chesapeake Utilities Corporation | Yes | Investment Committee Member | • Extensive financial, regulatory and industry experience • Extensive leadership and strategic foresight evidenced by our growth from $95 million market capitalization at the end of 1999 to approximately $395 million at the end of 2010 • In-depth knowledge of the markets in Florida and on the Delmarva Peninsula |

PROPOSAL 2: With respect to Amend the Company’s Amended and Restated Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock from 25,000,000 to 50,000,000

The Compensation Committee focuses on aligning total compensation of our executive officers with our business objectives, thereby increasing stockholder value. Total compensation is comprised of: (i) base salary, which is a fixed element of compensation and is set at levels to attract and retain executive officers with skills and qualities that align with our culture and strategic goals, and (ii) short-term cash and long-term equity incentive compensation, which are two at-risk elements of compensation that incentivize executive officers based upon the achievement of pre-established financial and non-financial performance metrics over an annual period (in the case of the short-term cash incentive awards), and pre-established financial metrics over a three-year performance period (in the case of the long-term equity incentive awards).

Our compensation practices include the following:

The Compensation Committee is comprised of independent directors who retain discretion over the administration of our executive compensation program and discretion in determining the achievement of performance

The Compensation Committee retains an independent compensation consultant who advises on our executive compensation program and other matters

The Compensation Committee annually reviews the executive compensation program to ensure alignment with the Company's objectives

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - ii2

The executive compensation program uses multiple performance measures that focus on both short-term performance, as well as long-term execution of our strategic plan, and features a cap on the maximum amount that can be earned for any performance period

The Compensation Committee considers peer group and benchmarking data in its review of the executive compensation program

Executive compensation is tied to performance, thereby aligning a significant portion of compensation with the interests of stockholders

Executive officers are evaluated using a variety of quantitative metrics, including TSR relative to a peer group under the long-term incentive plan

Executive officers are subject to a compensation recovery policy

Executive officers participate in the same benefits that are available to other employees, have a cap on their life insurance benefit, and receive no perquisites other than a Company vehicle that is available for personal use, but which is treated as compensation

Executive officers do not receive excise tax gross-up protections

Executive officers receive dividends on equity incentive awards only to the extent the awards are earned and in proportion to the shares actually earned

Executive officers may not engage in hedging transactions and may not pledge any Company stock

Executive officers are subject to a double-trigger change-in-control vesting provision under the SICP

| Types of Fees | 2016 | 2015 | |||||

| Audit Fees | $ | 846,249 | $ | 767,176 | |||

| Audit-Related Fees | $ | 80,183 | $ | 54,238 | |||

| Tax and Other Fees | $ | 0 | $ | 0 | |||

(remainder of page left intentionally blank)

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - iii3

Meeting Time, Date and Location

The Meeting will be held at 9:00 a.m. Eastern Time on Wednesday,Thursday, May 3, 2017,7, 2020. The Meeting will be held in a virtual meeting format only. If you plan to participate in the Board Room of PNC Bank, N.A., 222 Delaware Avenue, 18virtual Meeting, please see the thInstructions for the Virtual Annual Meeting Floor, Wilmington, Delaware 19801.section in this Proxy Statement. Stockholders may participate in the Meeting by logging in at www.virtualshareholdermeeting.com/CPK2020. There will be no physical location for shareholders to attend the Meeting.

Who May Vote

Holders of the Company's common stock at the close of business on March 10, 2017,2020, the record date established by the Board, are entitled to vote at the Meeting. ThereAs of the record date, there were 16,331,88916,422,459 shares of our common stock outstanding as of this date.outstanding. These shares of common stock are our only outstanding class of voting equity securities. Each share of common stock is entitled to one vote on each matter submitted to the stockholders for a vote. The namedCompany's executive officers and directors, of the Company, collectively, have the power to vote 4.16 percent3.14% of these shares.

Proposals Requiring Your Vote

The named executive officersproposals to be voted on at the Meeting are provided below, along with the required vote for each proposal to be adopted, and the effect of abstentions and broker non-votes on each proposal. The Executive NEOs (as defined in the Glossary of Terms herein) and directors intend to vote their shares of common stock as follows:FOR each nominee in Proposal 1 and FOR each of Proposals 2 and 3. With regard to Proposal 1, if elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement.

| Proposal | Description of Proposal | Board Recommendation | Vote | Effect of Abstentions | Effect of Broker Non-Votes |

| Proposal 1 | Election of one Class II director for a two-year term ending in 2022 and election of four Class III directors | FOR each nominee | Plurality of the votes cast by the holders of shares present at the Meeting or represented by proxy and entitled to vote at the Meeting | No effect | No effect |

| Proposal 2 | |||||

| Non-binding advisory vote to approve the compensation of the Company's | FOR | ||||

| No effect | |||||

| Non-binding advisory vote to ratify the appointment of the | FOR | Approved, on a non-binding advisory basis, if a majority of the shares present at the Meeting or represented by proxy and entitled to vote support the proposal | Treated as votes against proposal | Brokers have discretion to vote | |

The appointed proxies will vote pursuant to their discretion on any other matter that is properly brought before the Meeting and at any adjournment or postponement of the Meeting in accordance with our Amended and Restated Bylaws, as amended (the "Bylaws").Bylaws. The Company is not aware of any other matter to be presented at the Meeting.

Instructions for the Virtual Annual Meeting

Participating in the Virtual Meeting.Due to the emerging public health impact of the coronavirus outbreak (COVID-19), this year's Meeting will be a virtual meeting. There will be no physical meeting location. A virtual meeting format offers the same participation opportunities as those opportunities available to stockholders at in-person meetings. Stockholders will be able to listen, vote and submit questions. To participate in the Meeting visit www.virtualshareholdermeeting.com/CPK2020 using your desktop or mobile device and enter the control number included on your proxy card. Once you login to www.virtualshareholdermeeting.com/CPK2020 and enter the

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 4

control number included on your proxy card, you may submit a question until the adjournment of the Meeting. Only questions pertinent to matters related to the Meeting will be answered during the Meeting, subject to time constraints. Any questions pertinent to matters related to the Meeting that cannot be answered during the Meeting due to time constraints will be responded to by management either telephonically or by email communication. The virtual platform for the Meeting is supported across numerous browsers. The Meeting will begin promptly at 9:00 a.m. Eastern Time on May 7, 2020. If you need technical assistance with the meeting platform when logging into the Company's virtual Meeting or prior to adjournment of the Meeting, please call the dedicated technical support number provided at www.virtualshareholdermeeting.com/CPK2020. Representatives will be available beginning at 8:30 a.m. Eastern Time. A recording of the Meeting will not be available after the adjournment of the Meeting.

Voting Instructions

Stockholders of Record.Record. If you are a registered stockholder, your proxy card will be voted at the Meeting if it is properly submitted and not subsequently revoked. If your proxy card is incomplete or if you do not provide instructions with respect to any of the proposals, the appointedyour proxy card will be voted in line with management's and the Board's recommendation for each Proposal and pursuant to the appointed proxy's discretion for any other business properly brought before the Meeting. If your proxy card is unclear as to how you intended to vote (e.g., multiple selections are made for one proposal), your proxy will be voted pursuant to the discretion of the appointed proxy.

Beneficial OwnershipOwnership.. If you held shares of our common stock through a bank, broker, trustee, nominee, or other institution (called “street name”) on March 10, 2017,2020, you are entitled to vote on the matters described in this Proxy Statement. You will receive this Proxy Statement, any other solicitation materials, and voting instructions through your bank, broker, trustee, nominee, or institution. If you do not provide voting instructions, your shares may constitute “broker non-votes” on certain proposals. Generally, broker non-votes occur on a non-routine proposal where a broker is not permitted to vote on that proposal without instructions from the beneficial owner. Broker non-votes are counted as present for purposes of determining whether there is a quorum, but are not counted for purposes of determining whether a matter has been approved. If you properly submit a proxy card, but do not provide voting instructions, your institution will not be permitted to vote your shares on Proposal 1 - election of directors and Proposal 2 - amendment to the Company's Amended and Restated Certificate of Incorporation, Proposal 3 -non-binding advisory vote to approve the compensation of the Company's named executive officers, and Proposal 4 - advisory vote on the frequency of "say-on-pay" votes to approve the compensation of the Company's named executive officers; however,Named Executive Officers. However, your institution will be able to vote your shares on Proposal 53 - non-binding advisory vote to ratify the appointment of our independent registered public accounting firm. As a result, if you do not provide voting instructions to your institution, your shares will have no effect on the outcome of Proposals 1 2, 3, and 4. We will reimburse the institution for reasonable expenses incurred in connection with their solicitation.2. If you plan to virtually attend the Meeting, you will need to bringreceive a valid proxy from theyour institution if you intend to vote your shares at the Meeting.

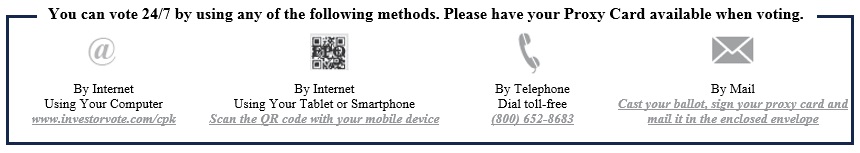

Methods Available Forfor Voting

Your vote is important and we encourage you to vote as soon as possible, even if you plan to virtually attend the Meeting. You may virtually attend the Meeting and electronically deliver your proxy card in person before voting is declared closed at the Meeting. You may vote at the Meeting even if you submitted your proxy using any of the methods below. Each of these voting methods are available 24/7 for your convenience. Please have your Proxy Card available when voting.

| Internet | Type www.proxyvote.com in your internet browser and enter the control number on your proxy card. | |

| Mobile Device | Scan the QR code on your proxy card with your mobile device and enter the control number on your proxy card. | |

| Telephone | Dial toll free (800) 690-6903 to reach our agent and follow the telephone prompts. | |

| Cast your ballot, sign and date your proxy card, and mail it in the enclosed envelope. | ||

If you own shares through your bank, broker or other institution or in an account established under one of the Company’s deferred compensation plans,Retirement Savings Plan, Deferred Compensation Plan, or other plan, you will receive this Proxy Statement, other solicitation materials, and voting instructions from your representative on how you can vote the shares you own in those accounts. We will reimburse the institutions for reasonable expenses incurred in connection with their solicitation.

Signing the Proxy - Stockholder Representatives or Joint Stockholders

If you are an authorized officer, partner or other agent voting shares on behalf of a corporation, limited liability company, partnership or other legal entity, you should sign the accompanying proxy card in the entity name and indicate your name and title. If you are an agent, attorney, guardian or trustee submitting a proxy card on behalf of a registered stockholder, you should also indicate your title with your signature. If you own stock with multiple parties, each party should sign the proxy card. If stock is registered in the name of a decedent and you are an executor, or an administrator, of the decedent’s estate, you should sign the accompanying proxy card, indicate your title following your signature, and attach legal instruments showing your qualification and authority to act in this capacity.

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - 25

| Proposal | ELECTION OF DIRECTORS |

| 1 | The Board recommends a vote FOR each of the director nominees. The Board, upon recommendation of the Corporate Governance Committee, nominated five incumbent directors - Thomas J. Bresnan, Ronald G. Forsythe, Jr., Lila A. Jaber, Dianna F. Morgan and John R. Schimkaitis. The Board has a diverse combination of leadership, professional skills, and experience that support our business and long-term strategic focus. |

Board Composition and Voting

General InformationInformation.. As of the date of this Proxy Statement, the entire Board consists of teneleven directors divided into three classes. Directors are elected to serve three-year terms. Directors are electedterms by a plurality of the votes cast by the holders of the shares present in personat the Meeting or represented by proxy and entitled to vote at the Meeting. In December 2015, the Board amended the Company’sOur director resignation policy, which is set forth in our Corporate Governance Guidelines, to adoptapplies when a director resignation policy that would apply in cases where a nominee for director receives more “withheld”“withhold” votes than votes “for” his or her electionvotes in an uncontested director election at a stockholder meeting. The Corporate Governance Guidelines are available at www.chpk.com/our-company/corporate-governance/.

Voting for Director Nominees.Each share of our common stock is entitled to one vote. You may authorize a proxy to vote your shares on the election of directors. A proxy that withholds authority to vote for a particular nominee will count neither for nor against the nominee.

Director NominationsNominations. . TheOn November 6, 2019, the Board increased the size of the Board from ten to eleven directors and appointed Lila A. Jaber to fill the resulting vacancy, effective January 1, 2020. Pursuant to the Company’s Bylaws a director chosen to fill a vacancy holds office until the next annual meeting of stockholders, at which such director will be nominated for election. On February 26, 2020, the Board confirmed the size of the Board at eleven directors and upon recommendation of the Corporate Governance Committee has nominated fourthe following five incumbent directors -directors: i) Lila A. Jaber to serve as a Class II director until the 2022 Annual Meeting of Stockholders and until her successor is elected and qualified, and ii) Thomas J. Bresnan, Ronald G. Forsythe, Jr., Dianna F. Morgan and John R. Schimkaitis. If elected, these directors willSchimkaitis to serve as Class III directors until the 20202023 Annual Meeting of Stockholders and until their successors are elected and qualified. If elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement. Also, if prior to the election, any of the nominees become unable or unwilling to serve as a director of the Company, (an eventuality that we do not anticipate), all proxies will be voted for any substitute nominee who may be designated by the Board pursuant tobased on the recommendation of the Corporate Governance Committee. The Company’s Bylaws provide the framework for director nominations and director eligibility for election or re-election as a director of the Company.

Director Family Relationships. There are no family relationships among any of our directors, nominees for directors, or executive officers.

Director Biographies, Key Attributes, Experience and Skills.Descriptions of the director nominees and continuing director's principal occupation and employment, principal business, affiliations, and other business experience during the past five years are provided beginning on the next page.

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - 36

DIRECTOR NOMINEE - CLASS II - TERM EXPIRES IN 2022 If elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement. | |||

| LILA A. JABER | ||

Ms. Jaber is President of Jaber Group Inc., a consulting firm. Ms. Jaber retired in 2019 from Gunster Yoakley & Stewart, P.A. where she served as Gunster's regional managing shareholder having led the regulatory law and legislative government affairs practice in Florida and assisted in developing the firm’s presence in Central and North Florida. Ms. Jaber was appointed by the Governor to serve two terms (1995-2005), initially as Commissioner, and then Chair of the Florida Public Service Commission overseeing the state’s implementation of economic regulatory policy and procedures for the energy and natural gas industries. In 2015, Ms. Jaber launched Florida’s Women in Energy Leadership Forum to celebrate the success of women leaders in the energy industry and their role in growing Florida’s economy and diversified workforce. A life-long servant leader, Ms. Jaber serves as a trustee on the Stetson University Board of Trustees, is past chair of Leadership Florida, former vice-chair and founding member of the Big Bend Minority Chamber of Commerce, and past inaugural chair of the City of Tallahassee’s Independent Ethics Board. Ms. Jaber was named the 2019 Lifetime Advocacy honoree by the Big Bend Minority Chamber of Commerce, received the Tallahassee Women Lawyers Diversity & Inclusion Award, and in 2016, received the commission of Kentucky Colonel by Kentucky’s Governor. | |||

Director since 2020 Independent Director Age 53 | |||

Key Attributes and Skills: •Extensive experience in strategy, ethics, and government affairs •Established relationships with colleagues and members of the business and political community throughout Florida •In-depth knowledge of the energy industry and regulatory policy | |||

DIRECTOR NOMINEES - CLASS III - TERMS EXPIRE IN 2023 If elected, directors are subject to the Company’s Bylaws, including the current age eligibility requirement. | |||

| THOMAS J. BRESNAN | ||

Mr. Bresnan is an entrepreneur who owns and has served as President of the Career School of the Rockies, and also of Denver Accounting Services since 2012 and 2014, respectively. He served as President of Global LT, a language and cross-cultural training company from 2017 until 2019 and has served as a member of its Board since 2014. From 2008-2012, Mr. Bresnan served as a majority stockholder, President and Chief Executive Officer of Schneider Sales Management, LLC. He previously served as a member of the Board, and President and Chief Executive Officer of New Horizons Worldwide, Inc., an information technology training company. He has also served as President of Capitol American Life Insurance, Chief Financial Officer at Capitol American Finance, and has held positions at Arthur Andersen & Co. | |||

Director since 2001 Independent Director Age 67 Audit Committee Chair and Financial Expert Investment Committee Member | |||

Key Attributes and Skills: •Extensive leadership, technology, sales and marketing experience •In-depth experience in acquisitions and the post integration process •Financial and Audit Committee expertise | |||

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 7

| RONALD G. FORSYTHE, JR. | ||

| Dr. Forsythe has served as Chief Executive Officer of Qlarant Corporation since July 2015. Qlarant Corporation previously operated as Quality Health Strategies until its comprehensive rebranding and new name formation in February 2018. He served as President of Quality Health Strategies from July 2015 until February 2018 and as its Chief Operating Officer from 2012-2015. He previously served as Chief Information Officer and Vice President of Technology and Commercialization at the University of Maryland Eastern Shore, and as an IT consultant for a large water and wastewater utility. He has served as a member of the Regional Advisory Board of Branch Banking and Trust Company, the Board of the Peninsula Regional Medical Center Foundation, and on the Higher Education Advisory Boards for Sprint Corporation and Gateway Computers. Dr. Forsythe also previously served as a member of Quality Health Foundation, and Horizons® at the Salisbury School. He is a NACD Board Leadership Fellow and was recognized by Savoy Magazine as one of 2017’s Most Influential Black Corporate Directors. | |||

Director since 2014 Independent Director Age 51 Audit Committee Member and Financial Expert Compensation Committee Member | |||

Key Attributes and Skills: •Extensive experience in leadership, organizational positioning, energy, community engagement, and technology including cyber security •Established relationships with colleagues and members of the community throughout the Delmarva Peninsula •Financial and Audit Committee expertise | |||

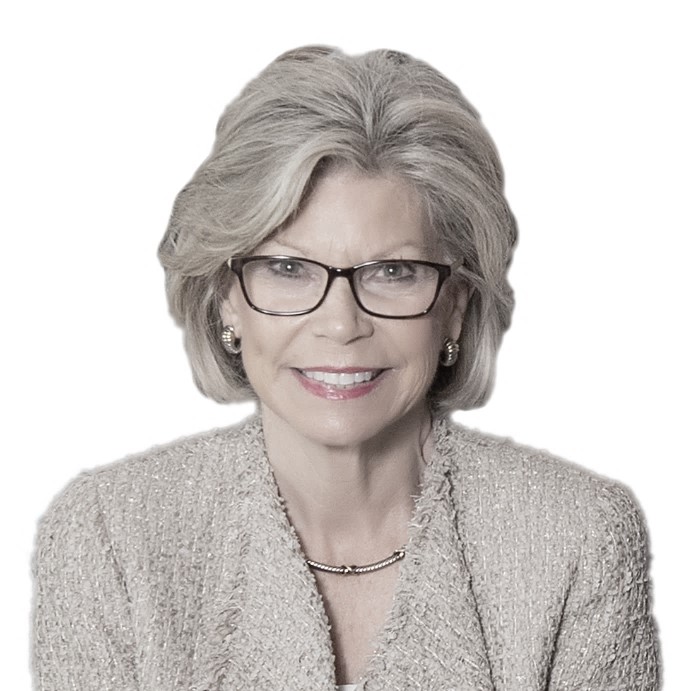

| DIANNA F. MORGAN | ||

| Ms. Morgan retired in 2001 from Walt Disney World Company where she served as Senior Vice President of Public Affairs and Human Resources. She previously oversaw the Disney Institute - a leader in experiential training, leadership development, benchmarking and cultural change for business professionals around the world. Ms. Morgan is a member of the Boards of Marriott Vacations Worldwide Corporation, CNL Healthcare Properties, Inc., and Hersha Hospitality Trust. Ms. Morgan serves as a member of Marriott's Compensation Policy, and Nominating and Corporate Governance Committees. She also serves as Chair of Hersha's Risk Sub-Committee, and as a member of Hersha's Audit, Compensation, and Nominating and Corporate Governance Committees. Ms. Morgan is the past Chair of the Board of Trustees for the University of Florida, Orlando Health, and the National Board for the Children’s Miracle Network, as well as a former member of the Boards of CNL Hotels & Resorts, and CNL Bancshares, Inc. | |||

Director since 2008 Independent Director Age 68 Compensation Committee Chair Corporate Governance Committee Member | |||

Key Attributes and Skills: •Extensive public company, leadership development, and organizational culture experience •Expertise in human capital, public affairs and the customer experience •In-depth knowledge in media relations and government relations | |||

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 8

| JOHN R. SCHIMKAITIS | ||

Mr. Schimkaitis retired in 2010 as President and Chief Executive Officer of Chesapeake Utilities Corporation. He previously served as Executive Vice President and Chief Operating Officer of the Company and held various other financial and managerial positions throughout his career at Chesapeake Utilities from June 1984 - December 2010. His leadership, business acumen and astute skills successfully led the Company through a period of diversification and growth, including the execution in 2009 of the Company's largest acquisition. Mr. Schimkaitis has served as Chair of the Board of Chesapeake Utilities since 2015 and was Vice Chair of the Board from 2010-2015. | |||

Director since 1996 Independent Director Age 72 Chair of the Board Investment Committee Member | |||

Key Attributes and Skills: •Extensive financial, regulatory and industry experience •Extensive leadership and strategic foresight evidenced by our growth from $95 million market capitalization at the end of 1999 to approximately $395 million at the end of 2010 •In-depth knowledge of the markets in Florida and on the Delmarva Peninsula | |||

| CONTINUING DIRECTORS - CLASS I - TERMS EXPIRE IN 2021 | |||

| THOMAS P. HILL, JR. | ||

Mr. Hill retired in 2002 from Exelon Corporation where he served as Vice President of Finance and Chief Financial Officer of Exelon Energy Delivery Company. Exelon Corporation is an electric utility that provides energy generation, power marketing and energy delivery. Mr. Hill previously served as Vice President and Controller for PECO Energy, a predecessor company of Exelon Corporation, and held various senior financial, managerial, and other positions during his tenure which began in 1970. Mr. Hill is a Trustee at Magee Rehabilitation Hospital, a member of the Thomas Jefferson University hospital system, and served as Chair of the Audit Committee, and member of the Finance and Investment Committee until August 2018. He is also a Trustee of the Magee Rehabilitation Foundation and Trustee of Abington Memorial Hospital. He served on the Audit Committee for Jefferson Health System, Inc. until its corporate restructuring in 2014. | |||

Director since 2006 Independent Director Age 71 Audit Committee Member and Financial Expert Investment Committee Member | |||

Key Attributes and Skills: •Extensive energy industry experience with energy generation, supply portfolios, marketing and delivery •In-depth knowledge of utility engineering principles and procedures, regulatory environment and utility operations •Financial and Audit Committee expertise | |||

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 9

| DENNIS S. HUDSON, III | ||

| Mr. Hudson has served as Chairman of the Board of Seacoast Banking Corporation of Florida since 2005 and Chief Executive Officer since 1998, and as Chairman of the Board and Chief Executive Officer of Seacoast National Bank since 1992. He is the former President and Chief Operating Officer of these entities and has held various managerial positions. Mr. Hudson served as a Director and member of the Audit Committee of FPU prior to its acquisition by Chesapeake Utilities. He is an independent Trustee, member of the Audit Committee, and Chair of the Nominating Committee of Penn Capital Funds. He serves on the Boards of the Community Foundation of Palm Beach and Martin Counties, and Visiting Nurses Association of Florida. Mr. Hudson previously served on the Boards of Martin Health System, Helping People Succeed, and the United Way of Martin County, as well as serving as Chair of the Economic Council of Martin County and member of the Miami Board of Directors of the Federal Reserve Bank of Atlanta. | |||

Director since 2009 Independent Director Age 64 Audit Committee Member and Financial Expert Compensation Committee Member | |||

Key Attributes and Skills: •Extensive public company, leadership, and banking experience •In-depth knowledge of the Florida markets •Financial and Audit Committee expertise | |||

| CALVERT A. MORGAN, JR. | ||

Mr. Morgan is the former special advisor to WSFS Financial Corporation, a multi-billion dollar financial services company. Mr. Morgan served as a member of the WSFS Board and the Audit, Corporate Governance and Nominating, Personnel and Compensation, and Trust Audit Committees until 2019. He also served as a member of the Board and Vice Chair of its principal subsidiary, WSFS Bank. Mr. Morgan is the retired Chair of the Board, President and Chief Executive Officer of PNC Bank, Delaware. He is a member of the Delaware Economic and Financial Advisory Council which provides advice to the Governor and Secretary of Finance on financial and economic conditions involving the State. Mr. Morgan previously served as Chair of the Delaware Business Roundtable, and continues to serve as a Trustee of Christiana Care Corporation. In 2019, Mr. Morgan was inducted into the Delaware Business Leaders Hall of Fame by the Junior Achievement of Delaware Leadership Council. | |||

Director since 2000 Independent Director Age 72 Corporate Governance Committee Chair Compensation Committee Member Investment Committee Member | |||

Key Attributes and Skills: •Approximately 49 years of banking, trust and finance experience and executive leadership expertise •Extensive public company experience •Broad knowledge of the business and economic climate in Delaware | |||

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 10

CONTINUING DIRECTORS - CLASS II - TERMS EXPIRE IN 2022 | |||

| EUGENE H. BAYARD | ||

Mr. Bayard is Of Counsel with the law firm of Morris James LLP in Georgetown, Delaware. He was a partner with the predecessor law firm of Wilson Halbrook & Bayard where he has served clients since 1974. Mr. Bayard serves in numerous business and community board capacities including: Delaware State Fair, Inc.; Chair of Harrington Raceway & Casino; O.A. Newton & Son Company; J.G. Townsend Jr. and Company; Southern Delaware Advisory Board for WSFS Bank; President of Delaware Wild Lands, Inc.; and Mid-Del Charitable Foundation. Mr. Bayard previously served as a member of the Board of the Delaware Community Foundation. | |||

Director since 2006 Independent Director Age 73 Corporate Governance Committee Member | |||

Key Attributes and Skills: •Extensive expertise in the Delaware legal community, home of the nation’s preeminent forum for Delaware corporations and other business entities •Established relationships with colleagues and members of the community throughout the Delmarva Peninsula •In-depth knowledge of legal, regulatory, and corporate governance practices | |||

| JEFFRY M. HOUSEHOLDER | ||

Mr. Householder was appointed as President and Chief Executive Officer of Chesapeake Utilities Corporation effective January 1, 2019. He previously served as President of Florida Public Utilities Company from 2010 until December 31, 2018. Mr. Householder has more than 30 years of experience in the energy industry and has served in leadership positions with TECO Energy Peoples Gas, West Florida Gas Company, Florida City Gas, and Tallahassee Utilities. He serves on the Boards of the American Gas Association, the Edison Electric Institute, the Southern Gas Association, and the Florida Natural Gas Association. Mr. Householder is a member of the Delaware Business Roundtable, which focuses on the business and economic climate of Delaware and fostering growth. | |||

Director since 2019 President and CEO, Chesapeake Utilities Corporation Age 62 Investment Committee Chair | |||

Key Attributes and Skills: •Extensive natural gas industry and regulatory experience •Extensive leadership and strategic foresight •Knowledge of the business and economic climate in our service territories, including Florida | |||

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 11

| PAUL L. MADDOCK, JR. | ||

Mr. Maddock is the Chief Executive Officer and Manager of Palamad, LLC, a real estate holding company located in Palm Beach, Broward, and Dade counties. Mr. Maddock is a member of the Board, Corporate Governance, and Executive Committees of W.C. & A.N. Miller Company, a real estate company in Washington, D.C. He served as a Director and member of the Audit, Compensation and Executive Committees of FPU prior to its acquisition by Chesapeake Utilities. He previously served as Director, Audit Committee Chair, and Executive Committee member of Lydian Bank and Trust, as well as a member of the Boards of PRB Energy, Inc., Wachovia Bank of Florida, 1st United Bank and Trust, and Island National Bank and Trust. Mr. Maddock is the President of THRIFT, Inc., a Palm Beach charitable organization, and is a former Director of the Good Samaritan Hospital. | |||

Director since 2009 Independent Director Age 70 Corporate Governance Committee Member | |||

Key Attributes and Skills: •Extensive public company and utility experience •Expertise in a broad range of real estate matters •In-depth knowledge of the Florida economy | |||

| |

The Board recommends that stockholders vote FORthe approval of the compensation of the Company's NEOs. We promote a pay-for-performance culture by designing an executive compensation program that includes base salary, as well as short and long-term performance-based incentive awards. Our Compensation Committee | |

| ||||

| |

| |

| |

| |

| |

| |

| |

| |

The advisory resolution, commonly known as a "say-on-pay" proposal, provides you the opportunity to express your views on our executive compensation program for the Company's NEOs. The resolution is responsible for executionrequired by Section 14A of the Company’s strategic plan and providing leadership and oversightExchange Act. We ask you to vote FOR the following resolution: "RESOLVED, that the stockholders of Chesapeake Utilities Corporation approve, on a non-binding, advisory basis, the compensation of the Company’s businesses. Mr. McMasters previously servedNamed Executive Officers as Executive Vice President and Chief Operating Officerdisclosed in this Proxy Statement for the 2020 Annual Meeting of Stockholders."

Voting for the Approval of the Company from 2008 to 2010. Mr. McMasters joined the Company in 1980. During his tenure with the Company, he has also served as Chief Financial Officer, Senior Vice President, Vice President, Treasurer, Director of Accounting and Rates, and Controller. He serves on the Board of DirectorsCompensation of the American Gas Association. Mr. McMasters is also a memberCompany's NEOs. Each share of the Delaware Business Roundtable.

vote. Proposal 2 will be adopteddeemed to be approved, on an advisory basis, if a majority of the Company’sCompany's outstanding common stock present in personat the Meeting or represented by proxy and entitled to vote affirmatively votes in favor of this proposal. Consequently, abstentionsAbstentions will have the same effect of votes castas a vote against this proposal and brokerproposal. Broker non-votes will have no effect on the outcome of this proposal. If this proposal is approved by the stockholders,advisory vote.

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - 912

Compensation Committee Role

General Information. The Compensation Committee is responsible for the oversight and administration of the Company’sCompany's executive compensation program. The Compensation Committee designs, recommends to the Board for adoption, and administers all of the policies and practices related to executive compensation. The Committee, to the extent that it deems appropriate (and, in the case of any of the Company's employee benefit plans, to the extent permitted by the plan), may delegate the day-to-day administration of matters under its authority to employees of the Company, or a subcommittee, subject in all cases to the Committee's oversight.

Independence of Committee Members. On February 24, 2017,26, 2020, the Board determined that none of the Compensation Committee members had any material relationship with the Company in accordance with the NYSE Listing Standards and with the Company's Corporate Governance Guidelines on Director Independence (the "Independence Guidelines"), which are more stringent than the NYSE Listing Standards. Guidelines. Thus, each member of the Compensation Committee is independent, and, other than in their capacity as a director and member of the Compensation Committee and other Committees,Board committees, has no other relationship or arrangement with the Companyus or any of its named executive officers.the NEOs.

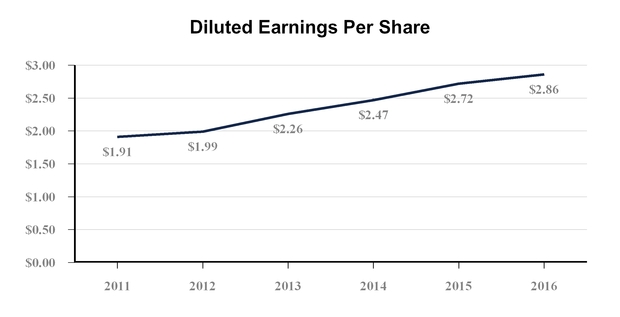

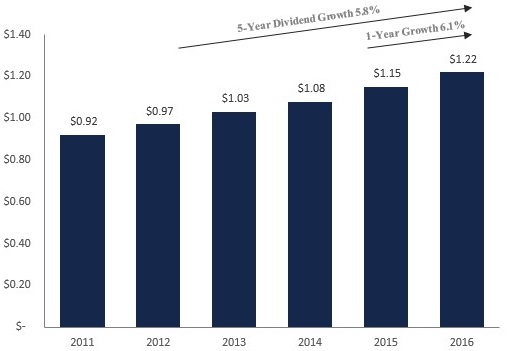

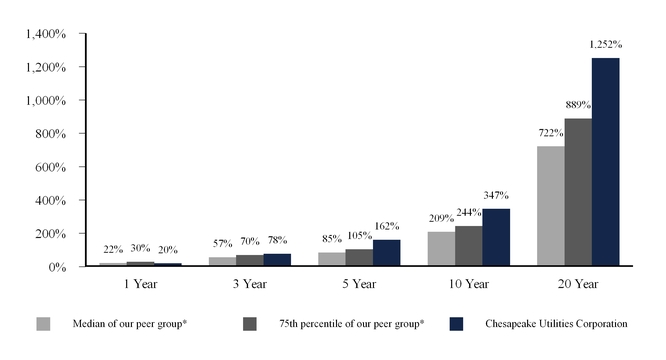

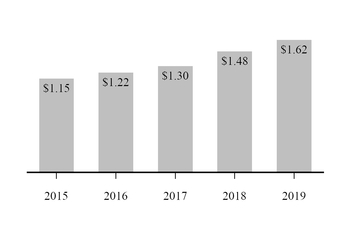

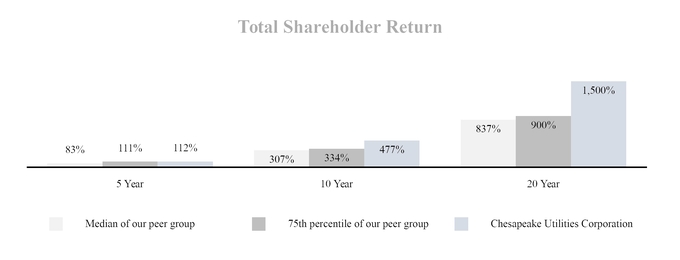

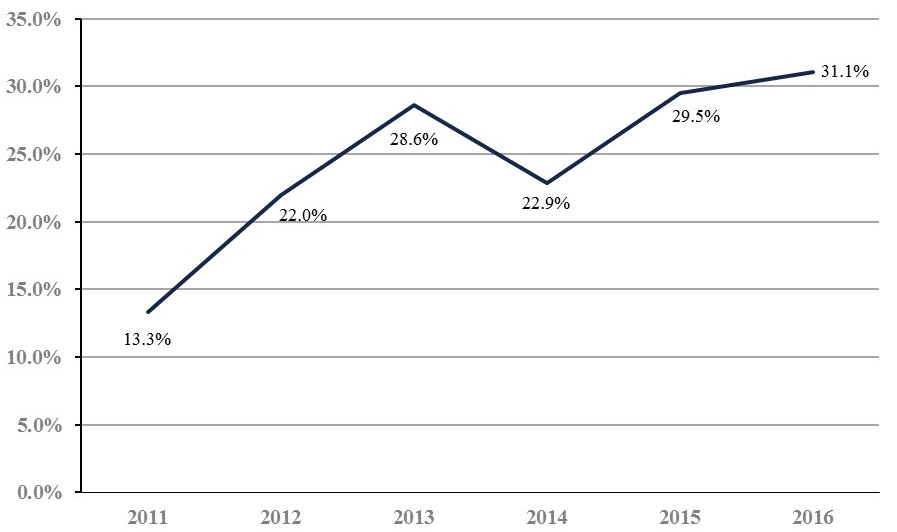

Philosophy and Design of Executive Compensation Program. The philosophy of our current executive compensation program is provided in detail in the Compensation Discussion and Analysis section of this Proxy Statement, which begins on page 30.Statement. The section also provides stockholders with comprehensive information on the design of our executive compensation program, as well as the mix of compensation that the Compensation Committee believes aligns the financial interests of the named executive officersNEOs with the interests of our stockholders. During the Compensation Committee’s annual review of executive compensation, it considers several elements of the executive compensation program, including, but not limited to: (i) the effectiveness of the program in attracting and retaining highly qualified individuals that have a solid foundation and comprehensive perspective of the Company, its operations and competitive environment; (ii) the complex nature of our operations as a diversified energy company; and (iii) the long-term focus on our strategic planning process. Additional information on our executive compensation program, including tables and accompanying narratives, is available in the Executive Compensation section of this Proxy Statement, which begins on page 43.Statement. The executive compensation program is centered on the premisecreation of creating stockholder value. This isvalue, evidenced by the payment of consecutive annual dividends to stockholders for 5659 years and the Company’sCompany's earnings performance over many years. The dedication of the Company’sour employees and the commitment and leadership of the Company’s named executive officersour management team have driven the Company’sCompany's growth, in terms of market capitalization, from $95$301 million in 1999at the end of 2009 to approximately $1.1more than $1.5 billion as ofat December 31, 2016. Over one, three, five, ten2019. Chesapeake Utilities’ compound annual total shareholder return has exceeded 14% for the past 3, 5, 10 and twenty20 year periods stockholders have earned more than 13.9% annually on their investment in the Company.ended December 31, 2019.

The Compensation Committee promotes a pay-for-performance culture to further align executive interests with the long-term interests of stockholders. The executive compensation program designed by the Compensation Committee places a majority of the named executive officers’ targetexecutive's total direct compensation at risk. Under the current executive compensation program, each executive officer isofficers are eligible to receive, an equity incentive award based on the achievement of pre-established long-term performance metrics. This equity incentive award comprises the largest performance-based component of each namedour executive officers’ compensation.compensation program. The Compensation Committee works directly with Frederic W.FW Cook, & Co. (“Cook & Co.”), its independent compensation consultant, in designing the executive compensation program. In December 2016,February 2019, FW Cook & Co. provided the Compensation Committee with a market analysis to assess the competitiveness of total compensation for the named executive officers.Company's Executive NEOs for 2019 as further discussed in the Compensation Discussion and Analysis and Executive Compensation sections of this Proxy Statement. The report compared the Company’s payCompany's compensation against market data for the Company’sCompany's peer group, as well as market information from published survey sources. The independent compensation consultant’s report concluded that;that for 2019: (i) named executive officertarget total direct compensation is within afor the Executive NEOs was, in aggregate, below the competitive range of the market median for the Company’sCompany's peer group; and (ii) the executive compensation program promotes a culture of pay-for-performance as a majority of the named executive officers’ compensation is at risk.

| • | The Compensation Committee retains discretion in administering all awards and performance goals, and determining performance achievement; |

| • | Each incentive award features a cap on the maximum amount that can be earned for any performance period; |

| • | Dividends on the equity incentive awards accrue in the form of dividend equivalents during the performance period and are only paid |

| • | Stock ownership requirements are in place for |

| • | |

| • | The |

| • | |

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - 1213

| Proposal | NON-BINDING ADVISORY VOTE TO RATIFY THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 3 | The Board recommends a vote FOR the ratification of the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for 2020. Prior to the reappointment of Baker Tilly, the Audit Committee considered factors such as Baker Tilly's professional qualifications, past performance, quality and level of transparency, expanding utility practice, internal annual evaluations, as well as the length of time the firm has been engaged. |

Appointment of External Audit Firm

The Audit Committee is solely responsible for the appointment, oversight, retention, and termination of the work of the Company’sCompany's independent registered public accounting firm (also referred to in this Proxy Statement as “external audit firm”), including the approval of all engagement fees, terms, and the annual audit plan. On February 23, 2017,25, 2020, the Audit Committee approved the reappointment of Baker Tilly to serve as our external audit firm for 2017.2020. Baker Tilly (independently or through a legacy firm) has served as the Company’s external audit firm since 2007. In determining whether to reappoint Baker Tilly as the Company’s external audit firm, the Audit Committee took into consideration several factors, including an assessment of the professional qualifications and past performance of the Lead Audit Partner and the audit team, the quality and level of transparency of the Audit Committee’s relationship and communications with Baker Tilly, and the length of time the firm has been engaged. The Audit Committee considered, among other things, Baker Tilly’s expanding utility practice and the knowledge and skills of Baker Tilly’s auditing experts that would be providing services to the Company.

Evaluation of External Audit Firm

The Audit Committee previously established criteria and procedures used to evaluate the quality of the audit services. The evaluation focuses on the qualifications and performance of Baker Tilly; the quality and candor of the external audit firm’s communications with the Audit Committee and the Company;Company management; and the external audit firm’s independence and objectivity. In 2016,2019, each member of the Audit Committee, as well as members of management and Internal Audit, completed an evaluation of the quality of the audit services rendered in 2015.2018. The questions were specifically developed for the individualeach respondent given his or her relationship with the external audit firm. The Audit Committee analyzed the results of the assessment, which provided the Audit Committee with additional insight into the effectiveness and objectivity of the Company’sCompany's external audit firm. The Chair of the Audit Committee and the Chief Financial Officer communicated the results of the evaluation process to Baker Tilly’s Lead Audit Partner. The CompanyWe will be undertakingundertake the same process in 20172020 for 2016. 2019's audit services.

The Audit Committee takes additional measures to ensure the audit team is independent and has the experience that createsto facilitate an audit of the highest quality. These measures include, but are not limited to: (i) independently meeting with the external audit firm to discuss communications and other appropriate matters, (ii) pre-approving the audit and non-audit services performed by the external audit firm in order to assure that they do not impair the auditor’s independence, (iii) overseeing the process for the rotation of the Lead Audit Partner to ensure the Lead Audit Partner has the knowledge, experience and quality to sustain the integrity of the Company’s audits and the requisite knowledge inof the Company’s business and expected areas of future growth, and (iv) periodically overseeing the process to solicit proposals from external audit firms to review, among other things, the experience, qualifications, technical abilities, and competitiveness of the audit fees in the industry prior to appointment of the external audit firm.

Non-Binding Advisory Vote to Ratify the External Audit Firm

Although the NYSE listing standards require that the Audit Committee be directly responsible for selecting and retaining the external audit firm, we are providing you with the means to express your view on this matter. While this vote is not binding, in the event that stockholders fail to ratify the appointment of Baker Tilly, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion may direct the appointment of a different external audit firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

Each share of our common stock is entitled to one vote. Proposal 3 will be deemed to be approved, on an advisory basis, if a majority of the Company's outstanding common stock present at the Meeting or represented by proxy and entitled to vote affirmatively votes in favor of this proposal. Abstentions will have the same effect as a vote against this proposal. Brokers will have discretion to vote on this proposal.

A representative from Baker Tilly will be presentavailable at the Annual Meeting and available to respond to appropriate questions. A formal statement will not be made.

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement - 1314

3 - AUDIT RELATED MATTERS

Audit Committee Report

To the Stockholders of Chesapeake Utilities Corporation:

The primary functions of the Audit Committee include assisting the Board of Directors in fulfilling its fiduciary responsibilities by providing informed, vigilant, and effective oversight of:

The Company’s accounting policies, procedures and controls;

The performance of the internal audit function;

The appointment, retention, termination, compensation and oversight (including the assessment of the qualifications and independence) of the independent auditors;

The quality and integrity of the Company’s consolidated financial statements and related reports;

The Company's risk management processes; and

The Company’s compliance with legal and regulatory requirements.

This Audit Committee Report is provided by the Audit Committee of the Board of Directors and pertains tobeing submitted in conjunction with the Company’s audited financial statements for the year ended December 31, 2016. Prior2019. In conjunction with our oversight responsibilities, prior to the issuance of the Company’s unaudited quarterly financial statements and annual audited financial statements, wethe Committee reviewed and discussed the earnings press releases, consolidated financial statements and disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (including significant accounting policies and judgments) with management, the Company’s management, internal auditors, and the independent external auditors. Weregistered public accounting firm, Baker Tilly Virchow Krause LLP (“Baker Tilly”). The Committee also reviewed the Company’s policies and practices with respect to financial risk assessment, as well as its audit firm,conferred with Baker Tilly Virchow Krause LLP ("Baker Tilly"),on the matters required to be discussed by the applicable audit standards adopted byrequirements of the Public Company Accounting Oversight Board (the "PCAOB"), including and the Auditing Standard No. 1301, Communications with Audit Committees ("AS No. 1301"Securities and Exchange Commission (the "SEC"), which was originally adopted as auditing Standard No. 16, Communications with Audit Committees ("AS No. 16"), but was renumbered effective December 31, 2016..

The Committee discussed with Baker Tilly the overall scope and plan for theirits audit and approved the terms of theirits engagement letter. WeThe Committee also reviewed the Company's internal audit plan. WeThe Committee met with Baker Tilly and with the Company's internal auditor, in each case, with and without other members of management present, to discuss the results of their respective examinations, the evaluation of the Company’s internal controls and the overall quality and integrity of the Company’s financial reporting. The Committee also met regularly with management to discuss accounting, auditing, internal control, financial reporting, earnings and risk management processes and matters. The Committee has received the written disclosures and the letter from Baker Tilly required by applicable requirements of the PCAOB regarding Baker Tilly’s communications with the Committee concerning independence, and has discussed with Baker Tilly its independence. Beginning in 2019, the Committee also engaged in substantive dialogue with Baker Tilly, including training and planning, related to the implementation of the new auditing standard focused on Critical Audit Matters (“CAMs”). The Committee and Baker Tilly engaged in dialogue regarding the audit and expected CAMs to understand the nature of potential CAMs, Baker Tilly’s basis for the determination of the CAM included in their report and how the CAM will be described in their audit report. The discussion of the CAM in Baker Tilly’s report captures and is consistent with our dialogue regarding these matters.

Based on the Committee’s review and the discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 20162019 for filing with the SecuritiesSEC.

The Audit Committee has appointed Baker Tilly to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2020. In determining whether to appoint Baker Tilly, the Audit Committee took into consideration various factors, including the historical and Exchange Commission (“SEC”).recent performance of Baker Tilly on the audit; the professional qualifications of the firm and the lead audit partner; the quality of ongoing discussions with Baker Tilly; the results of internal surveys of Baker Tilly’s service and quality; the appropriateness of fees; and evidence supporting the firm’s independence, objectivity and professional skepticism. Although the Audit Committee has sole authority to appoint the independent registered public accounting firm, the Committee has recommended that the Board seek stockholder ratification of the appointment at the Annual Meeting as a matter of good governance.

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 15

The information in this Audit Committee Report shall not be considered to be “soliciting material” or be “filed” with the SEC, nor shall this information be incorporated by reference into any previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company incorporated it by specific reference. This reportAudit Committee Report is provided by the following independent directors, who comprise the Audit Committee:

THE AUDIT COMMITTEE

|   |   |   |

| Thomas J. Bresnan, Chair | Ronald G. Forsythe, Jr. | Thomas P. Hill, Jr. | Dennis S. Hudson, III |

Fees and Services of the Company's Independent Auditors

The following provides information on fees for professional services rendered by Baker Tilly for the two years ended December 31, 20162019 and 2015.2018.

Audit Fees

The aggregate fees that Baker Tilly billed to the Company and its subsidiaries by Baker Tilly in 20162019 and 20152018 totaled $846,249$940,054 and $767,176,$963,551, respectively. Fees for professional services rendered included fees associated with implementation of the new requirement for our external auditors' to communicate critical audit matter(s) in the audit report issued in connection with the audit of our financial statements for 2019; implementation of the new lease accounting standard, ASC 842, Leases; implementation of Accounting Standards Update 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities; implementation of the revenue recognition standard, Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers; matters in conjunctionconnection with the audits of the financial statements included in our Annual ReportReports on Form 10-K; the reviews of the financial statements included in our Quarterly Reports on Form 10-Q; the audits of certain of our subsidiaries or operations typically performed for statutory and regulatory filings or engagements; the audits of internal control over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002, including the testing of Aspire Energy of Ohio's internal controls for the first time in 2016;2002; and the issuance of their consents associated with our registration statements that were filed with the SEC during those two years. In 2016, Baker Tilly also issued a comfort letter in connection with the Company's placement of $57.4 million of new common stock (net proceeds).2018.

Audit-Related Fees, Tax and Other Fees

The aggregate fees billed for audit-related services were $61,146 and $59,262 for 2019 and 2018, respectively. During 20162019 and 2015,2018, Baker Tilly performed annual audits on our benefit plans for the plan years ended December 31, 20152018 and 2014,2017, respectively. The aggregate fees billed for audit-related services were $80,183 and $54,238 for 2016 and 2015, respectively. Fees for professional services rendered in 2016 included services performed in connection with the Company's business development opportunities. The Company did not engage Baker Tilly to provide any tax services or any services other than those described above.

Audit and Non-Audit Services Pre-Approval Policies and Procedures

The Audit Committee pre-approves the audit and non-audit services performed by the Company’sCompany's external audit firm in order to assure that they do not impair the external audit firm’s independence. The Audit Committee may also pre-approve tax services provided by the external audit firm, if any. In November 2016,2019, the Audit Committee reviewed its Audit and Non-Audit Services Pre-Approval Policy and made no changes. Under this policy, the Audit Committee may pre-approve specific services in advance or may pre-approve one or more categories of audit and non-audit services. For all proposed services, the Audit Committee will, among other things, consider whether the external audit firm is the best positioned to provide the proposed services most effectively and efficiently based on its familiarity with the Company’sour business, people, culture, accounting systems, risk profile and other factors, and whether the services are likely to enhance the Company’sour ability to manage or control risk or improve audit quality. The Audit Committee may establish ceilings on the level of fees and costs of generally pre-approved services that may be performed.

The Audit Committee has delegated to the Chair of the Audit Committee (and(who may delegate authority to any other member of the Audit Committee) authority to pre-approve up to $40,000 in audit and non-audit services, which authority may be exercised when the Audit Committee is not in session. At least annually, the external audit firm is required to report to the Audit Committee on the specific services provided and the amounts that have been paid to the external audit firm. The Chief Financial Officer is required to report to the Audit Committee on the specific services provided and the amounts paid by the Company. The Company's Internal Audit departmentteam is responsible for monitoring and reporting on the performance of all services provided by the external audit firm and to determine whether these services are in compliance with the Audit Committee’s policy. In 20162019 and 2015,2018, the Audit Committee approved 100 percent100% of all audit and non-audit services provided to the Company by Baker Tilly.

CHESAPEAKE UTILITIES CORPORATION - 20172020 Proxy Statement 15

4 - BOARD OF DIRECTORS AND ITS COMMITTEES

Board Leadershipof Directors

Board Oversight. The Board is elected by the Company’sCompany's stockholders to oversee the direction and strategy of the business that is being carried out by management and to ensure that itthe Company continues to operate in the best interests of all stakeholders. On behalf of our stockholders, the Board and its Committees monitor corporate performance, the integrity of financial controls, and the effectiveness of our compliance and risk management programs, including cyber security. The Board works diligentlyalso oversees plans for the succession of key executives and is integrally involved in the strategic planning and capital budget processes, as well as establishing key financial and operational metrics. This year-round oversight process is facilitated through the diversity of our Board who has a broad range of personal and professional skills, experience and expertise in leadership, corporate governance, board service, energy, economics, finance, public affairs, academia, and entrepreneurism. The Board is also comprised of a majority of directors who have served as chief executive officers at other organizations and bring skillful business acumen to fulfillthe boardroom. Collectively, the incumbent Board has a vast amount of diverse experience and established personal and professional relationships in the communities we serve.

Board Culture. The Board has a strong boardroom culture that enables directors to express their opinions openly in the boardroom and engage in candid dialogue. Directors are strongly encouraged to attend the Board and Committee meetings, as well as the Annual Meeting of Stockholders. In 2019, nine of our eleven directors serving from our May 2018 to May 2019 Annual Meeting were in attendance at the 2019 Annual Meeting of Stockholders. Each director actively participated in 75% or more of Board and their respective Committee meetings held in 2019. The Board held six meetings during 2019. Board and Committee meetings were held in or around select service territories enabling the Board to remain connected with employees, customers, stockholders, and the communities we serve. Each independent director has access to our Chief Executive Officer and other members of the management team and may request agenda topics to be discussed in more detail at meetings of the full Board or one of its fiduciary dutiesCommittees. Directors may not serve on more than two other public company boards in accordance with our Corporate Governance Guidelines.

Business Performance. 2019 was a remarkable year as measured by any number of metrics. The leadership of the Board and the collective efforts of the Chesapeake Utilities team contributed to protectstrong financial results in 2019, including those metrics tied to performance-based compensation.

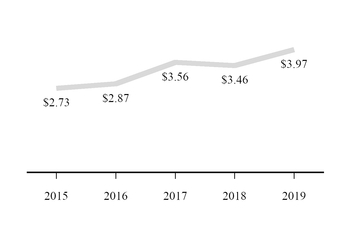

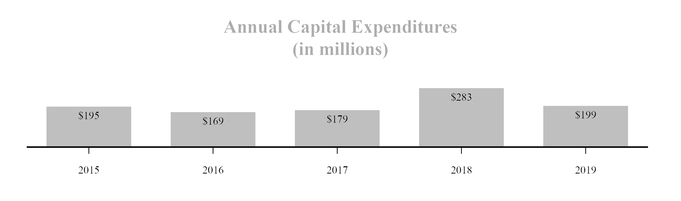

The Company's net income for the year ended December 31, 2019 was $65.2 million, or $3.97 earnings per share (basic), generating record performance for the Company. The growth and initiatives pursued by our businesses in 2019 generated increased EPS of $0.51 per share (2019 EPS of $3.97 per share versus $3.46 per share in 2018). Higher earnings for 2019 reflect increased gross margin from recently completed and ongoing pipeline expansion projects, incremental margin from the acquisition of certain assets of Marlin Gas Transport, R.F. Ohl Fuel Oil, Inc. and Boulden Inc., organic growth in the natural gas distribution operations, and higher retail propane margins. A Florida Public Service Commission regulatory order that enabled the Company to retain tax savings associated with lower federal tax rates resulting from the United States Tax Cuts and Jobs Act in several natural gas distribution operations and continued growth in gross margin from Aspire Energy also contributed to higher earnings growth in 2019. Finally, the sale of the assets of our natural gas marketing operation, net of their operating results pre-sale, contributed $0.24 per share. The strong gross margin growth and proceeds from the sale of this business more than offset $4.9 million in lower gross margin due to a decline in customer consumption as a result of warmer weather in 2019 compared to 2018. Excluding the impact of the sale of the natural gas marketing assets, the Company's results also represent record performance. 2019 EPS from continuing operations (which excludes discontinued operations of this business and the sale of its assets) was also a record $3.73 per share, an increase of $0.25 per share or 7.2% over 2018's EPS from continuing operations of $3.48 per share. Our strong financial results translated into a 12% ROE, or 11.3% in terms of continuing operations ROE. Over the past five years, we have generated an annual ROE ranging from 11.0% to 13.0%, which represents top quartile performance over the long-term when compared to our performance peer group. Our ROE has been driven by our innovative approach to cultivate, develop and consummate growth projects and initiatives and generating higher returns from our unregulated energy businesses. We have paid dividends to our stockholders without interruption for 59 years. The Board increased the annualized dividend in 2019 by 9.5% over the prior year reflecting our commitment to stockholder value through dividend growth that is cultivated from sustainable earnings growth. The efforts of the Chesapeake Utilities team throughout 2019 have positioned us for continued future growth in 2020 and beyond.

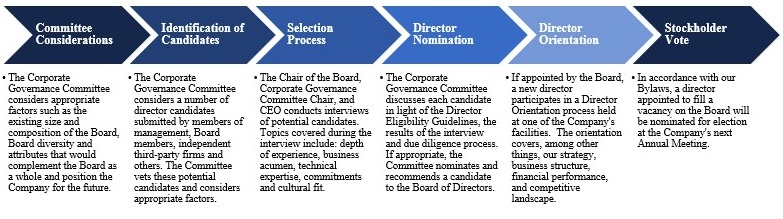

Director Nominations. Throughout the year, the Corporate Governance Committee evaluates board composition and board succession, including practices benchmarked against our peer companies, the S&P 500 and the top 100 U.S. public companies. The Committee considers a range of practices, including board size, average age of directors, tenure, retirement policies, diversity, in addition to other topics such as corporate culture, workplace ethics, and environmental, social and governance practices. The Committee discusses the Board’s current profile in the context of the Board as a whole over the near and long-term, director skills and attributes, as well as established guidelines which collectively help to inform our strategic plan. The Committee also considers feedback received during the Board evaluation process. The process may lead to the vetting of potential board candidates who we receive through contacts in the business, civic and legal communities and a variety of other sources or by third-party business partners. Prior to nominating a candidate, the Committee considers a multitude of factors, including biographical and other background information, criteria adopted by the

CHESAPEAKE UTILITIES CORPORATION - 2020 Proxy Statement - 17

Committee, the Company's governing documents, experience and relationships in the energy industry and the communities we serve, community involvement, a candidate’s availability and commitment level, and whether a candidate is independent under applicable rules and listing standards. The Committee also considers the Director Eligibility Guidelines, which include integrity, ethics, diversity, and the ability for a candidate to listen and work in a collegial manner. In addition, for new candidates, the Committee considers the results of the candidate’s interview, which is conducted by the Chair of the Board, Corporate Governance Committee Chair, and the Chief Executive Officer, where topics such as depth of experience, business acumen, technical expertise, commitments and cultural fit are discussed. Following this process, and if appropriate, the Committee nominates and recommends to the Board that it formally nominate the candidate to serve as a director. At each annual meeting, our stockholders vote to elect all director nominees for the applicable class. In the case of a director nominee appointed to fill a vacancy, the nominee will stand for election at our next annual meeting of stockholders, regardless of class. Once elected, a new director participates in our director orientation program held at one of our facilities. The program familiarizes the director with various aspects of the Company, including our strategy, business structure, financial performance and competitive landscape.